Finance

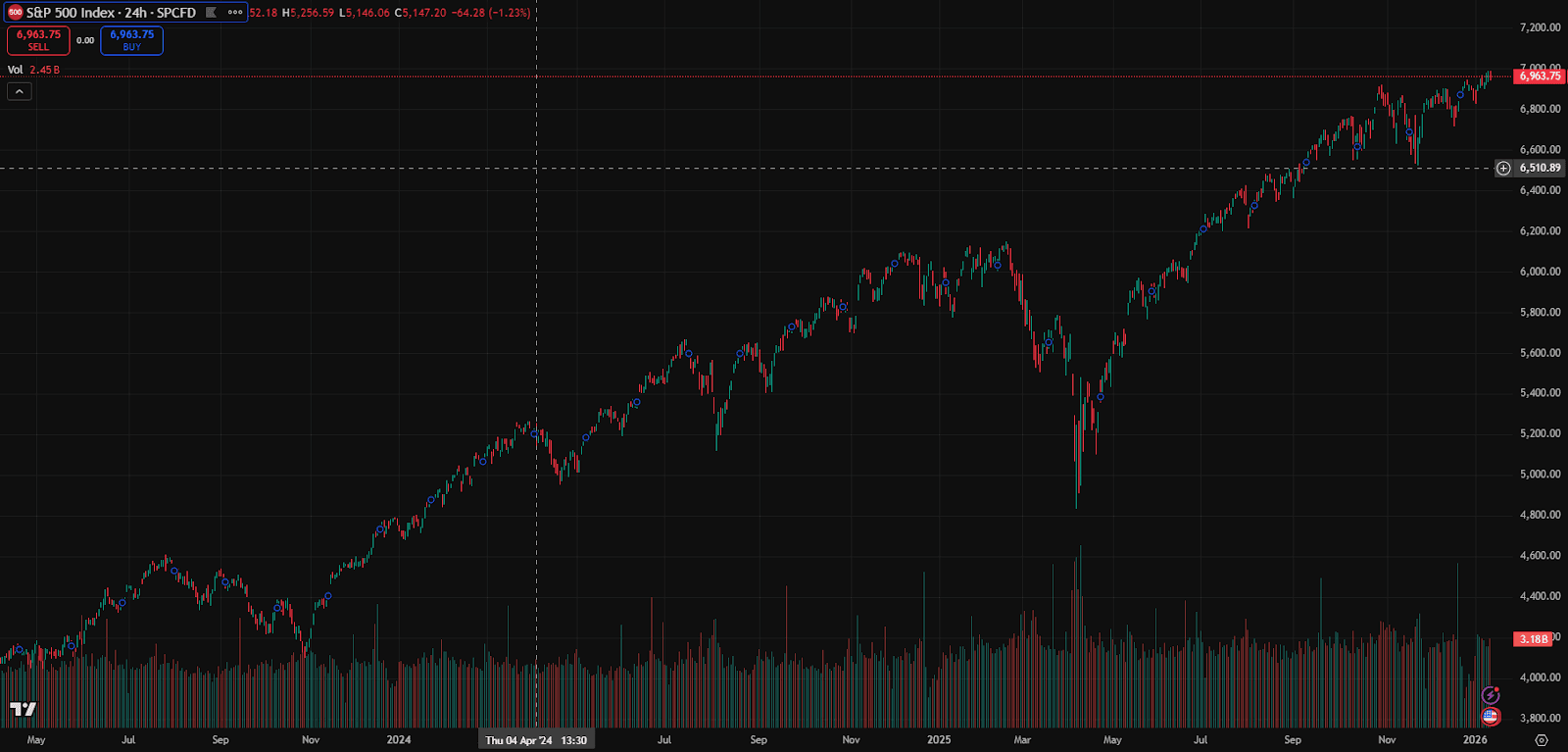

How the S&P 500 could make a run at 7,500 in 2026

Darren Reed

Jan 22, 2026

Round-number milestones have a funny way of becoming magnets for investor attention. “S&P 500 at 7,500” isn’t just a headline—it’s a psychological waypoint that can influence positioning, narratives, and ultimately flows.

Of course, no target is guaranteed. But if you’re looking for a coherent, bullish framework for how the index could plausibly reach 7,500 in 2026, it largely comes down to three reinforcing forces:

AI-driven growth and enthusiasm staying alive

A rate backdrop that becomes less restrictive

Earnings continuing to do the heavy lifting

Let’s break those down.

1) The AI trade isn’t just hype—momentum can keep pushing US equities higher

The “AI trade” has been one of the most powerful market narratives in years, and the key bullish argument is that it can remain self-reinforcing through 2026 for two reasons: real spending and powerful market mechanics.

AI spending is broadening beyond a handful of names

Early on, the gains were concentrated in obvious beneficiaries—semiconductors, hyperscalers, and the mega-cap platforms. A 2026 bull case assumes the next phase: AI capex and adoption spreads outward:

Enterprise software embeds AI features customers will actually pay for

Cloud providers keep building capacity (and pricing power holds up)

“Picks and shovels” demand expands: networking, power, cooling, cybersecurity, data tooling

Traditional industries invest to defend margins through productivity (automation, customer support, sales enablement, coding assistance)

In other words, it stops being “an AI story” and becomes a profitability + productivity story across more sectors.

Momentum matters more than people admit

Markets don’t move only on fundamentals—they move on positioning, flows, and narrative strength. When a theme feels durable, it tends to attract:

Systematic strategies chasing trend and volatility signals

Passive inflows that automatically buy the largest weights

Active managers trying not to underperform the benchmark

Retail enthusiasm returning on dips

If AI remains the dominant “growth engine” narrative, it can keep supporting higher multiples, especially for companies perceived as owning the next decade of cash flows.

Bullish takeaway: AI doesn’t need to be perfectly priced to keep working. It just needs to remain good enough—with visible revenue pathways and continued investment—to keep capital rotating toward US equities.

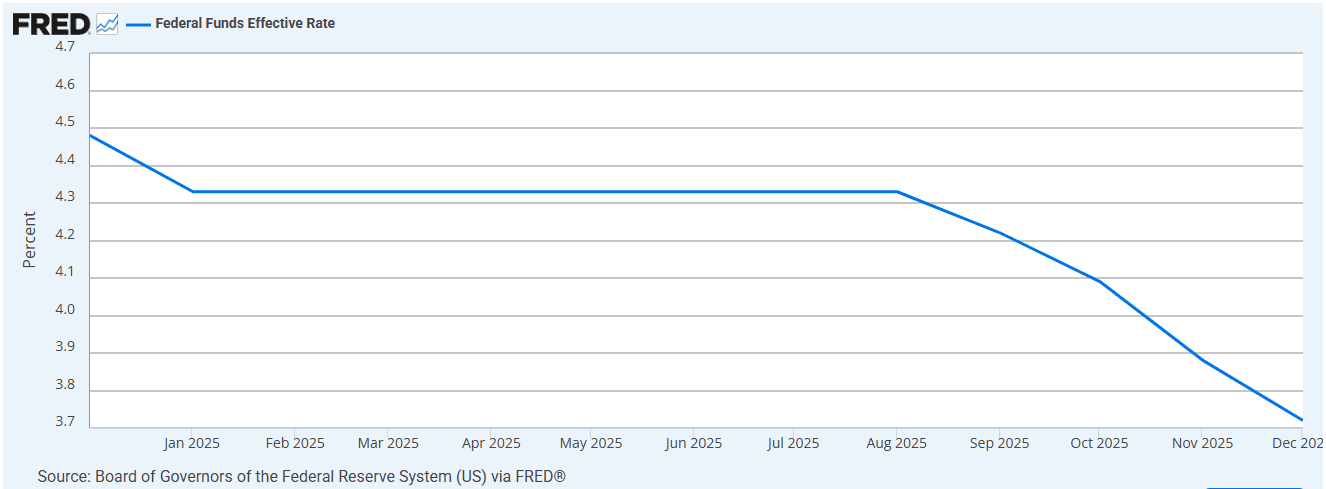

2) Lower interest rates through 2026 can support higher equity valuations

The second pillar of a 7,500 thesis is simple: the discount rate matters.

Even if you don’t build discounted cash flow models for fun, the concept shows up everywhere in markets:

Lower yields often make future earnings more valuable today

Lower borrowing costs can revive deal activity and capex

Lower rates reduce pressure on consumers and interest-sensitive sectors

Lower cash yields can push investors back out the risk curve (“TINA-lite”)

Why rate relief can lift the whole index

A decline in rates doesn’t only help speculative growth stocks. It can be a broad tailwind:

Housing and autos become less rate-choked

Small and mid caps get breathing room on refinancing and credit

Financial conditions loosen, which can improve risk appetite

Equity risk premium looks more attractive when bonds pay less

And importantly, lower rates can help justify higher valuation multiples without requiring earnings to explode.

The soft-landing sweet spot

The most bullish rate scenario for equities isn’t “rates fall because something breaks.” It’s:

inflation cools enough to allow easing, while growth stays resilient.

That combination tends to keep earnings intact and lifts valuation support at the same time—exactly the mix that can drive a big index milestone.

Bullish takeaway: if rates trend lower through 2026 in a “growth-holds-up” environment, valuation support can act like a rising tide under the index.

3) Earnings are the ultimate fuel—and the trend can stay higher

If the S&P 500 is going to sustainably move to 7,500, earnings have to participate. The cleanest bull case is that earnings growth remains solid and broader than just the mega-caps.

Operating leverage and productivity can surprise to the upside

Many companies spent recent years tightening costs. If revenue holds up while efficiency improves—especially through AI-assisted workflows—profit margins can expand.

Some of the most plausible earnings tailwinds in a 2026 bull scenario:

Productivity gains (automation, faster development cycles, leaner support functions)

Stabilizing input costs compared to the inflation shock era

Improved supply chains and fewer “one-time” margin headwinds

Buybacks supporting per-share earnings growth

Capex cycles (including AI-related) feeding into higher future revenue

Breadth is what makes the rally feel “real”

The market tends to feel more durable when more sectors contribute. A strong 2026 earnings story often includes participation from:

Industrials and infrastructure-linked names

Financials benefiting from better activity and steadier credit

Consumer sectors supported by easing financial pressure

Selected cyclicals if global growth isn’t collapsing

If investors believe earnings strength isn’t narrowly concentrated, they’re more willing to assign a healthier multiple to the index overall.

Bullish takeaway: sustained EPS growth—especially with improving breadth—can justify a higher index level without relying entirely on multiple expansion.

Putting it together: the 7,500 pathway is a combo of earnings + multiples

A credible bull narrative usually doesn’t assume just one lever. It assumes two engines working together:

Earnings growth provides the fundamental lift

A friendlier rate backdrop supports valuation multiples

AI momentum strengthens both (higher growth expectations + productivity-driven margins)

That’s how you get an environment where a milestone like 7,500 stops sounding extreme and starts sounding like “a stretch, but plausible.”

What could derail the bullish case?

No bull thesis is complete without naming the obvious tripwires:

AI enthusiasm cools if revenue realization disappoints or capex payoffs look thin

Rates fall for the wrong reason (recession/credit event), hurting earnings

Earnings growth narrows again, leaving the index dependent on a few names

Geopolitical shocks, energy spikes, or renewed inflation re-tighten conditions

These don’t negate the bull case—but they’re the reasons “7,500 in 2026” is a scenario, not a promise.

Bottom line

The bullish roadmap to S&P 500 at 7,500 in 2026 isn’t mystical. It’s a story of reinforcing tailwinds:

AI momentum keeps capital and optimism centered on US markets

Lower interest rates help valuations and risk appetite

Higher corporate earnings provide the foundation that makes gains stick

If all three line up—even imperfectly—7,500 becomes less about fantasy and more about probability.