Finance

Volatility Index Signaling Complacency Into Year-End

Darren Reed

Dec 24, 2025

What the VIX Is and What It Measures

The Cboe Volatility Index (VIX) is often called the market’s “fear gauge,” but it’s more precise to view it as the price of short-term insurance on the S&P 500. The VIX represents the market’s expectation of volatility over roughly the next 30 days, inferred from the implied volatility embedded in a broad strip of S&P 500 index options. When investors pay more for protective options, implied volatility rises and the VIX tends to increase. When demand for protection fades, implied volatility compresses and the VIX generally falls.

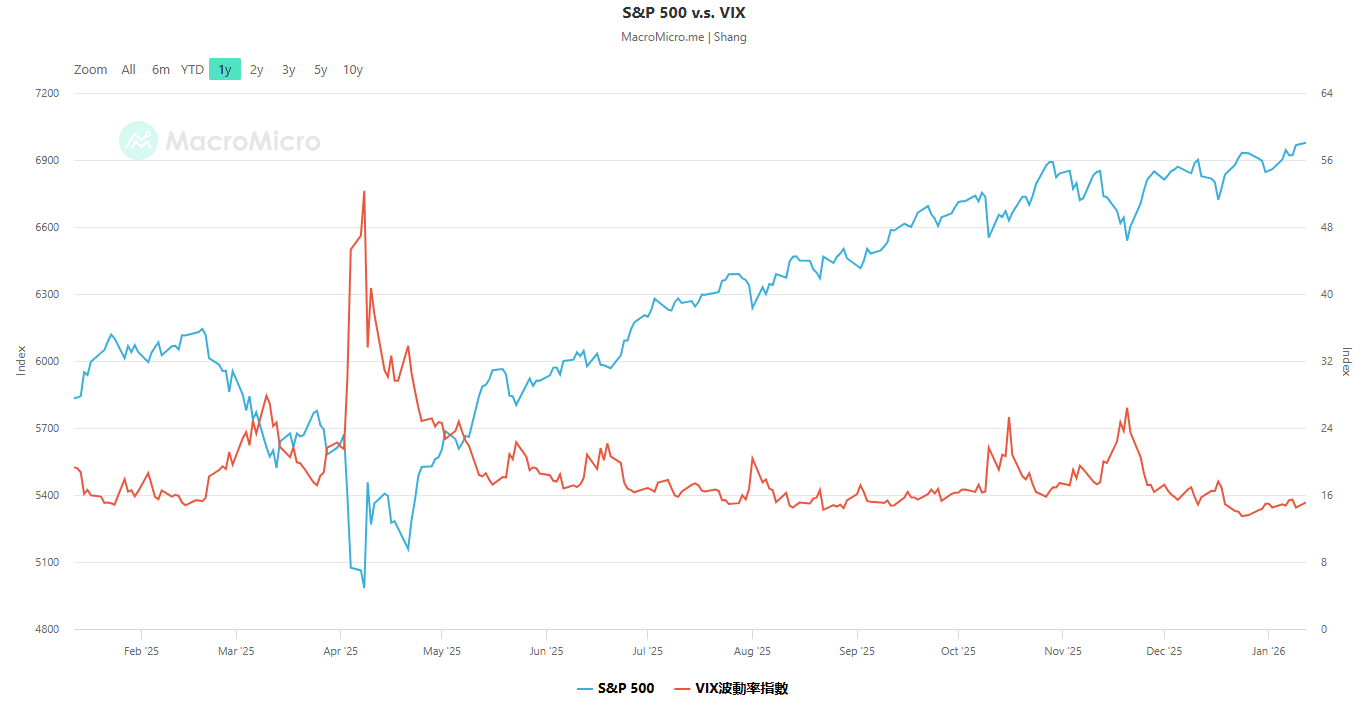

Why the VIX Often Moves Inversely to the S&P 500

Because it is derived from option prices, the VIX commonly trades inversely to the S&P 500. During equity drawdowns or risk-off shocks, investors rush to hedge downside risk—often by buying put options—driving up option premiums and implied volatility. The VIX rises as that “insurance” becomes more expensive. In risk-on periods, when equities trend higher and dips are quickly bought, hedging demand tends to ease and volatility sellers may add supply, helping push implied volatility (and the VIX) lower. The relationship isn’t perfect day-to-day, but over time the negative correlation is a frequent feature of how the index is constructed and used.

All-Time Highs and Compressed Volatility

A relatively low VIX compared with historical averages fits neatly with U.S. equities trading at or near all-time highs. When the S&P 500 is strong, realized volatility often stays subdued: pullbacks are smaller, sentiment is steadier, and investors feel less urgency to pay for protection. This can become self-reinforcing. As volatility remains contained, certain systematic strategies that adjust exposure based on volatility levels may keep or add to equity exposure, contributing to smoother price action. At the same time, consistent demand for yield-like returns from option premium selling can further suppress implied volatility.

Year-End Seasonality and the Christmas Rally

Seasonality can amplify this calm. The final weeks of the year are widely associated with the “Christmas rally,” when holiday-thinned trading, portfolio positioning, and generally optimistic sentiment can support equities. In a slow grind higher—rather than a choppy tape—implied volatility often compresses. With fewer perceived catalysts into year-end and many investors reluctant to make big reallocations during the holidays, the market’s willingness to pay for near-term insurance tends to soften, keeping the VIX muted relative to its long-run average.

A Low VIX Isn’t the Same as Low Risk

A low VIX describes how the market is pricing near-term uncertainty today—not a guarantee that uncertainty won’t spike tomorrow. If a surprise catalyst hits (a macro data shock, an abrupt shift in rate expectations, geopolitical escalation, or a sudden liquidity event), the VIX can reprice quickly. Historically, volatility tends to be mean-reverting: long quiet periods can give way to sharp bursts, and the VIX can move far faster than equities in stress regimes.

Bullish VIX Outlook and the ETF Angle

With the VIX trading historically low, a “bullish VIX” view is essentially a bet on volatility mean reversion: the idea that complacency and compressed option premiums leave room for an eventual repricing higher. In practical terms, when insurance is cheap, the asymmetry can look attractive—there may be more room for a volatility spike than for volatility to fall much further, especially if equities are already extended at all-time highs and seasonality fades into the new year.

It’s also important to connect this to how many popular VIX-linked ETFs and ETNs (e.g. VIXY and VXX, respectively) behave. Most are not direct, long exposure to the spot VIX; they typically gain exposure through VIX futures. When volatility rises, those products often rise as well, and can do so sharply during sudden spikes. However, their performance is heavily influenced by the shape of the VIX futures curve. In “contango” (when longer-dated futures are priced above near-dated), long VIX ETPs can experience significant drag over time from rolling futures forward—meaning they are generally better suited for tactical positioning around an anticipated volatility event rather than long-term holding. Still, for investors looking for convexity—a potential surge in payoff during an equity shock—low spot volatility levels can be the kind of backdrop that makes volatility exposure feel compelling, provided the risks and mechanics are well understood.